Empowering Agents

with Technology-Driven Risk Management

client retention, and drive revenue growth. Partner with us to offer unparalleled

service and insights to your clients.

The Benefits of Technology-Driven

Risk Management for Agents

Transform Your Business with Advanced Risk Management.

In today’s competitive market, insurance agents face the dual challenge of retaining clients while minimizing loss ratios. Our technology-driven risk management solutions empower agents to proactively manage risks, improve client satisfaction, and ultimately increase profitability.

By leveraging advanced data analytics, automated processes, and comprehensive insights, our solutions enable agents to make informed decisions, anticipate potential risks, and provide their clients with a secure and streamlined experience.

Lower Loss Ratios

Our risk management tools help agents identify and mitigate risks before they become claims, reducing overall loss ratios.

Boost Retention

Provide your clients with a seamless experience and added value, leading to higher client loyalty and retention rates.

Increase Revenue

Utilize premium savings insights and optimized policy offerings to create revenue-generating opportunities within your portfolio.

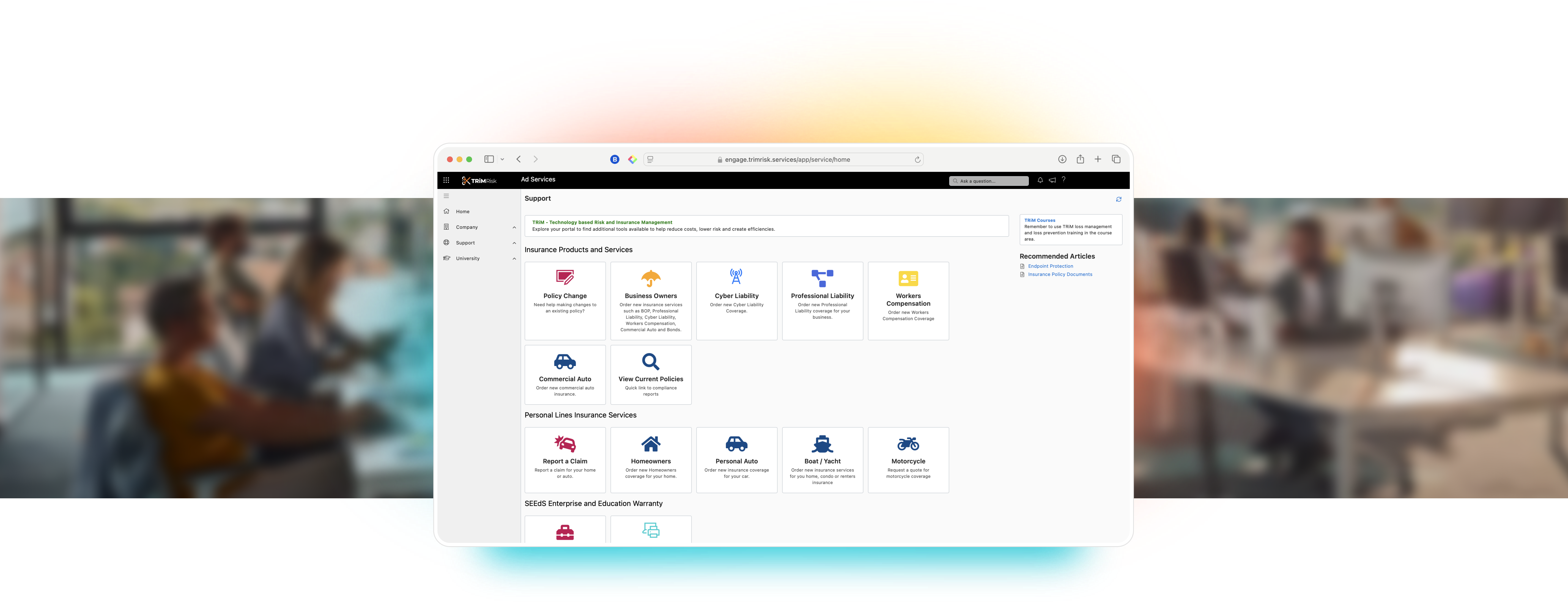

A Centralized Portal to Streamline Client Management

Our Unified Client Portal is specifically designed to simplify the agent’s workflow, providing an all-in-one platform for managing policies, assessing risks, and enhancing client communications.

Experience a new level of productivity and client satisfaction with the following tools.

Feature Highlights within the Portal

Policy Management

and Service

Manage your clients’

policies effortlessly, with features for renewals, updates, and service requests all in one place.

Risk Assessment

and Analytics

Access advanced analytics

and risk assessment tools to understand client profiles, anticipate potential issues, and offer proactive solutions.

Client Communication

Tools

Engage with clients through secure messaging, notifications, and a seamless platform for quick communication.

Premium

Savings Calculator

Calculate potential premium savings for clients based on risk factors, and provide data-backed recommendations.

Boost Your Performance with Our

Innovative Tools

your business outcomes.

Reduce Loss Ratios

With proactive risk assessments and real-time data, reduce your clients’ exposure to potential losses and claims.

Improve Client Loyalty

Offer a comprehensive and transparent experience that fosters trust and long-term relationships.

Create New Revenue Streams

Utilize premium savings and compliance insights to optimize client policies, providing new opportunities for revenue growth.

Trusted by Agents Nationwide: Real Experiences

with TRiM’s Risk Management Solutions

Ready to Transform Your Agency?

Get Started with TRiM.

ratios, and increasing revenue with TRiM’s technology-driven solutions.